The EPFO new withdrawal rules have created a lot of buzz lately. Everyone is talking about how these new PF changes might affect their savings and retirement plans.

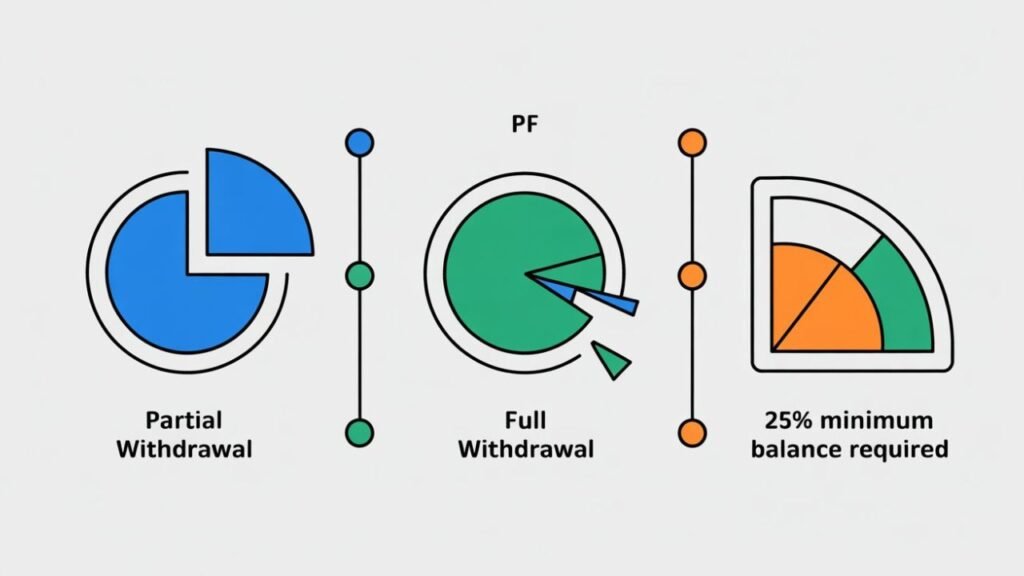

Short summary first: You can now access more of your PF in many cases, but EPFO asks you to keep 25% as minimum balance for some time. Also, full withdrawal after job loss is now allowed only after 12 months of unemployment (instead of 2 months earlier). This rule is meant to prevent people from making short-term withdrawals, so that retirement savings are saved.

Table of Contents

1) What exactly changed

I will break this into small bullets so it is easy.

- Minimum 25% must stay: If you try to withdraw after job loss, EPFO will ask you to keep at least 25% of the total PF corpus in your account for a certain time. That means you can take up to 75% in many cases, not 100% immediately. Moneycontrol

- Full withdrawal timeline changed: Earlier, if you were jobless for about 2 months, you could apply for final PF settlement. Now that waiting period is 12 months for full PF withdrawal in case of unemployment. Pension withdrawal rules also have longer timelines in some cases. Moneycontrol+1

- Partial withdrawals made simpler: EPFO ne partial withdrawal reasons ko group kar diya. Ab main categories hain — essential needs (education, medical, marriage), housing needs, and special circumstances (like natural disaster). For some reasons, you can withdraw multiple times (education up to 10 times, marriage up to 5 times).

- Easier rules for small claims and more digital work: Process will be more online. If your UAN, Aadhaar, and bank details are linked, many claims get auto-settled.

- There are some special cases: In very special conditions, EPFO allows higher withdrawal or even 100% under strict checks. Officials say in severe special cases rules are flexible.

2) Why EPFO Changed the Rules: The Real Reason Behind the EPFO New Withdrawal Rules

Simple reason: EPFO wants people to keep a part of their retirement savings.

Many people were withdrawing full PF early.Then when old age comes, there is no money.. EPFO wants to avoid that. So they made rules that give access but also protect the core money. Officials also say this helps subscribers keep getting interest and pension benefits.

Think of it like this: PF is for your later life. EPFO is saying — haan tumhe madad chahiye, lekin thoda paisa bacha ke rakhne do so future bhi secure rahe.

3) How the new rules affect you — real, small examples

I will give easy examples. This will help you understand how it works in daily life.

Example A — Raj, 28, leaves job and needs money

Raj leaves job in January. Under old rules he could get final PF money after 2 months. Under new rules Raj cannot get the full PF till he is unemployed for 12 months. He can, however, take up to 75% in many cases if needed but must leave 25% for the time specified.

Example B — Meena, 33, needs money for daughter’s college

Meena wants to pay fees. She can apply for partial withdrawal under education rules. Now education withdrawal is easier and allowed multiple times (up to limits). This helps her.

Example C — Suresh, 40, buying first house

For housing, EPFO allows higher withdrawal under the housing category. That means Suresh can use PF for house purchase, with the usual checks. Make sure to follow housing withdrawal rules.

Example D — Severe case (medical emergency)

If someone has big medical bills or other real emergency, EPFO has a “special circumstance” clause that may allow higher access. But expect proof and checks.

4) Who will like it and who will not

- Will like it: People who need partial money for house, education or medical reasons. Young parents who need short-term help. People who use PF for planned needs.

- Won’t like it: People who lose job and need full corpus fast. Freelancers or gig workers who rely on quick full withdrawal may be unhappy. Also people who expected 2-month full settlement earlier.

- Experts’ view: Financial advisors say keeping some money in PF is good because of compounding and pension rules. But critics say waiting 12 months is tough for those in immediate need. Both sides have points.

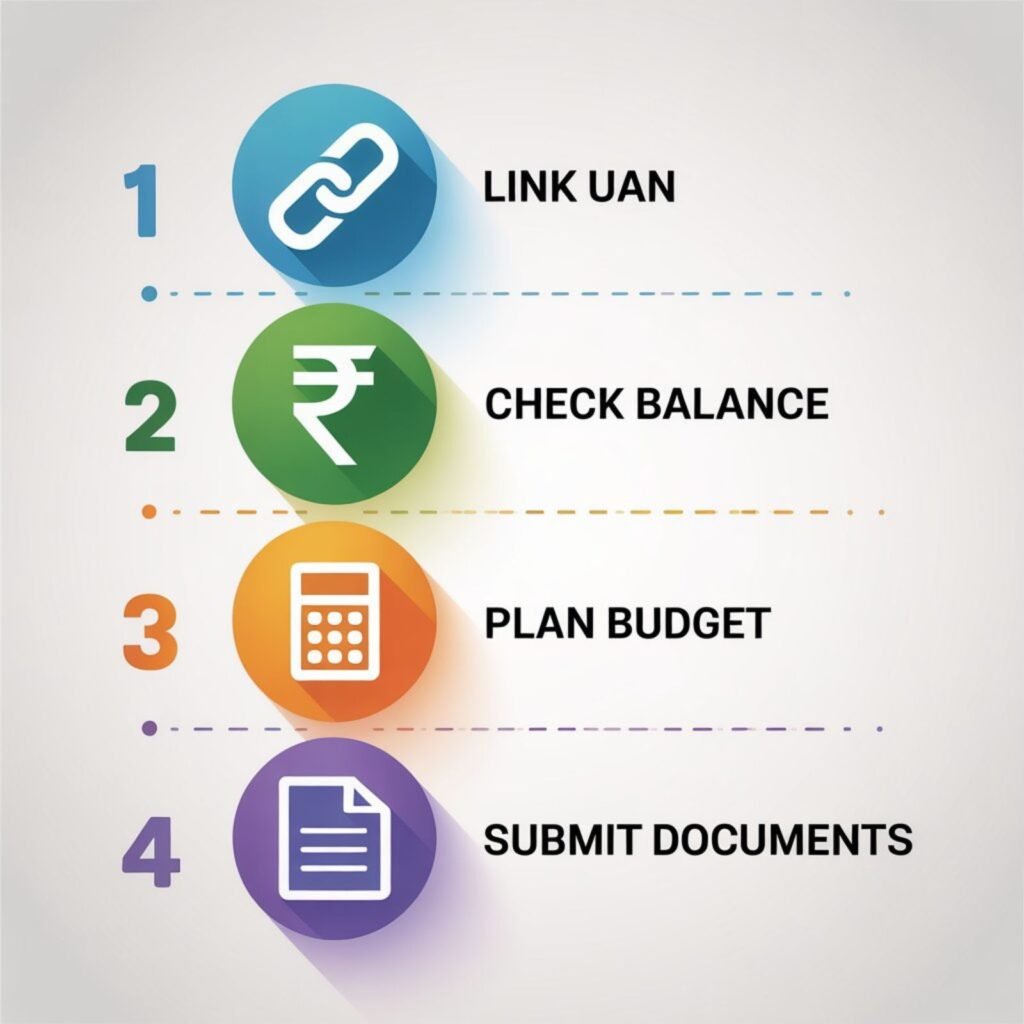

5) Quick things you should do today (action plan)

I will give 7 short, simple steps. Do these.

- Link UAN, Aadhaar and bank if not done already. Most claims are smoother this way.

- Check your EPF balance on the EPFO site or app. Know how much you have.

- Think twice before withdrawing everything. Keep long term in mind. Small withdrawals for real needs are better.

- If you lose job, plan budget for the next 12 months. Because full settlement may not be available till then.

- If buying house or paying education, check the exact partial withdrawal rules. There are limits and proofs needed.

- Keep documents ready (bank passbook, Aadhaar, ID). Makes claims faster.

- If in real emergency, ask about special circumstances. EPFO may allow exceptions with proof.

6) FAQs (short and plain)

Q. Can I take all my PF money if I leave job now?

A. Not right away. Full withdrawal after unemployment is allowed mainly after 12 months. Till then you may get up to 75% in many cases.

Q. How many times can I withdraw for education or marriage?

A. Education, up to 10 times. Marriage, up to 5 times, under new rules.

Q. Will my monthly PF deposits change?

A. No. Employer and employee share rules remain same for monthly contribution. These changes only affect withdrawal rules.

Q. Is EPFO forcing me to keep 25% forever?

A. No. The idea is to keep 25% for some time so you get interest and pension benefits. In some situations, if unemployment continues, there are routes to access more later. Officials have clarified some flexibility.

Q. Where to check official rules?

A. Always check EPFO official site and recent circulars. Your regional EPFO office can also help.

Final note — think before you withdraw

PF is not just a bank account. It is your long-term safety net. These new rules try to give help when you need it, while saving at least some money for your old age. If you can manage without taking everything out, do that. Compound interest works quietly, and over years it adds up.

If you need to act, plan, and don’t rush. Use partial withdrawal when possible. If you are jobless, make a clear plan for 12 months because full settlement may not be fast.

Disclaimer: This article is only for information and general guidance. Rules can change. Always check the official EPFO website (epfindia.gov.in) or talk to your EPFO regional office before applying for any withdrawal. This is not professional financial or legal advice.

Also Read:

Yo, 99okvip is where it’s at! Been playing here for a while now and I’m loving the vibe. Games are good, withdrawals are smooth. Highly recommend checking it out 99okvip

Alright, so ‘b66’. It’s a cool platform with lots of variety. I would really recommend it. Get it here: b66

Topvin, claiming to be the top? Bold statement, let’s see if they can back it up! Only one way to know, huh? Go check it now: topvin

Yo, 556betvip, this site is legit! I’ve been playing here for a while and the payouts are quick. Plus, they have a decent selection of games. Check it out for yourselves! 556betvip